BOSTON — Massachusetts Attorney General Andrea Campbell’s new consumer protection regulations prohibiting “junk fees” or deceptive pricing take effect in Massachusetts on Tuesday.

“Junk fees” are sometimes referred to as “convenience fees” or “service fees” on a bill. They’re usually a surprise and hike up the price of your overall purchase.

Businesses in the Bay State must now provide the total price of a product, including any fees or charges added on up front.

Campbell’s regulations ban hidden fees and impose strict rules on subscription trials and auto-renewals. They also require businesses to tell people whether fees are optional or required, and simplify the process for cancelling trial offers and recurring charges.

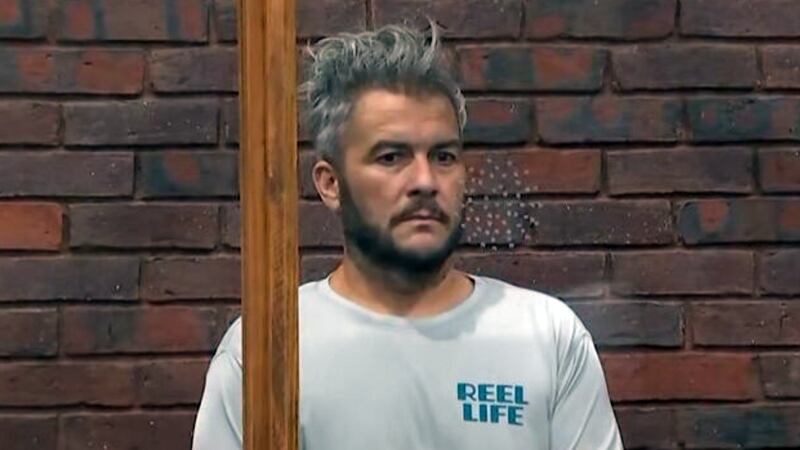

“You now have to be given an easy way to cancel and not have it automatically renew. You need to be warned ahead of time,” Edgar Dworsky of ConsumerWorld.org told Boston 25 News.

The Consumer Financial Protection Bureau said common junk fees include:

- Fees for overdraft or nonsufficient funds

- Late fees for not paying a bill on time

- Convenience fees

- Prepaid card fees

- Closing costs and homebuying fees

The regulations define what constitutes unfair or deceptive conduct when it comes to presenting prices, advertising trial offers, and managing contracts with auto-renewal features.

Campbell said junk fees unfairly hinder consumers from making price comparisons when shopping, since they are often undisclosed when prices are publicly marketed.

Campbell first proposed regulations to combat junk fees back in November 2023.

Download the FREE Boston 25 News app for breaking news alerts.

Follow Boston 25 News on Facebook and Twitter. | Watch Boston 25 News NOW

©2025 Cox Media Group